Cartoon Robot Toy Object for Small Children To Play, Flat Style Icon Stock Vector - Illustration of nice, educational: 192550136

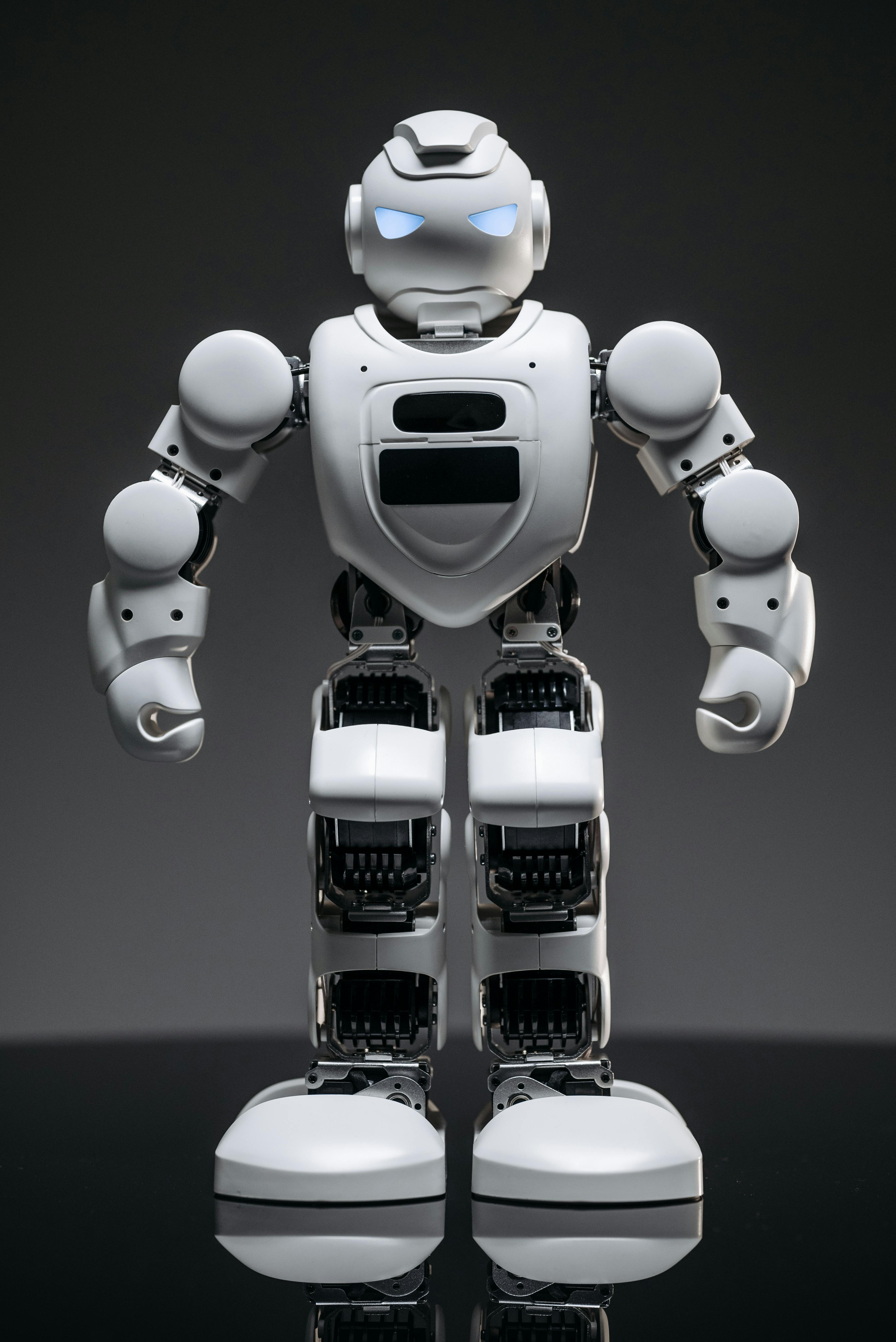

Ataques Niño Robot. Imagen Generada Por Ordenador Fotos, Retratos, Imágenes Y Fotografía De Archivo Libres De Derecho. Image 53798483.