ITW | AMD Ryzen 5 3600 Desktop Processor with MSI B450 Gaming Plus Max Motherboard Bundle | Shopee Philippines

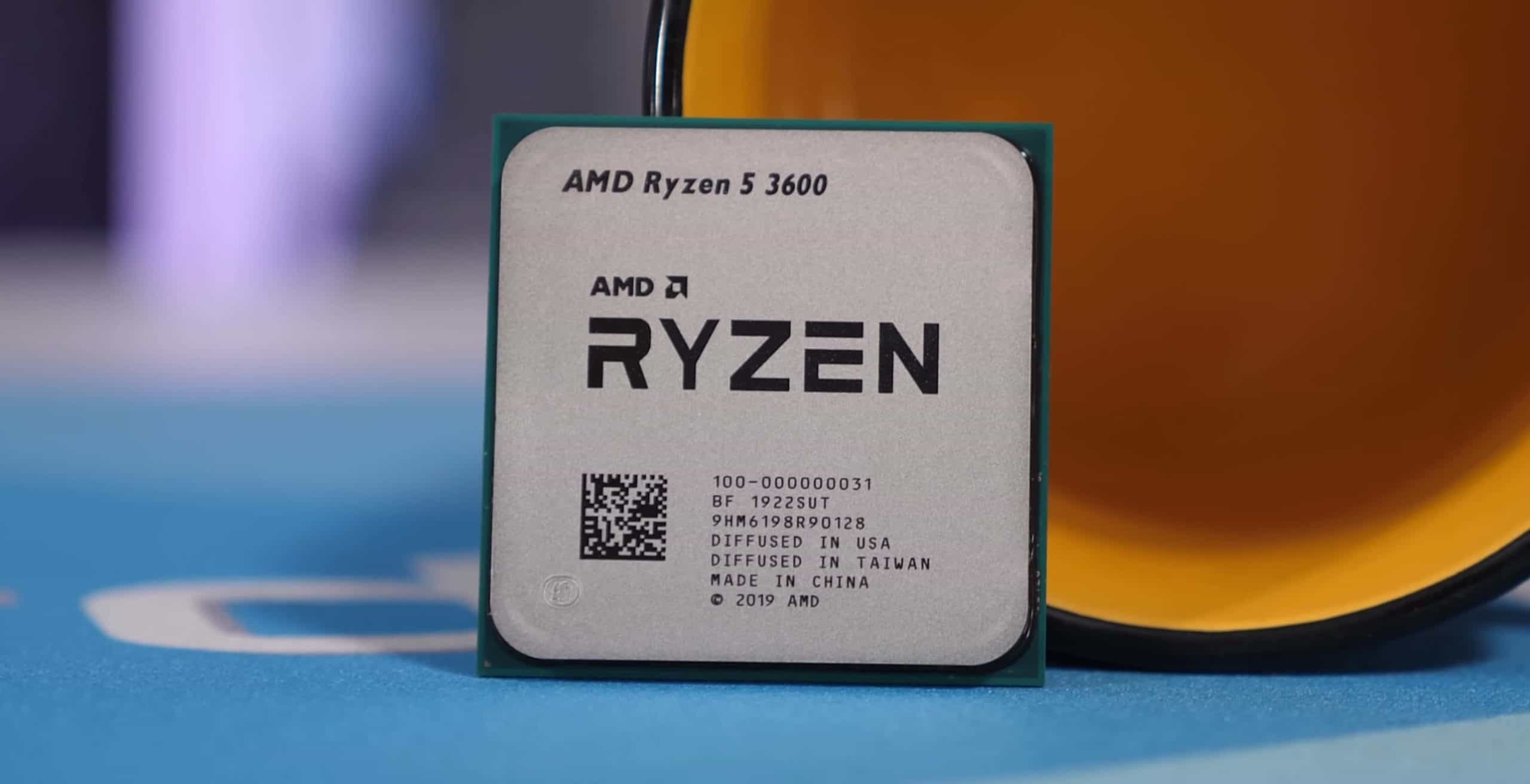

AMD Ryzen 5 3600 looks to beat the Intel Core i9-9900K in Geekbench, but it is not really a level playing field - NotebookCheck.net News

Amazon.com: AMD Ryzen 5 3600 6-Core, 12-Thread Unlocked Desktop Processor with Wraith Stealth Cooler : Everything Else

Amazon.com: AMD Ryzen 5 3600 6-Core, 12-Thread Unlocked Desktop Processor with Wraith Stealth Cooler : Everything Else

AMD CPUファン,AM4,5 3600コアプロセッサ,3600 r5 3.6 ghz,6コア,cpuプロセッサ,7nm,65w,l3 = 32m,100 000000031,ソケットam4|CPU| - AliExpress

Ryzen 5 3600 Processor | 6 Cores 12 Threads @ 3.6Ghz Base / 4.2Ghz Turbo (Brand New Chip) | Pollux PC Game Store

CLX SET Gaming Desktop AMD Ryzen 5 3600 16GB Memory NVIDIA GeForce RTX 3070 480GB SSD + 2TB HDD Black TGMSETRTM0C14BM - Best Buy

Ryzen 5 3600 outsells closest Core rival by nearly 13 to one as AMD hammers Intel into the ground in Mindfactory CPU sales data - NotebookCheck.net News